- Give

- Alumni

- Parents

John Brown University

2000 W. University St., Siloam Springs, AR 72761479-524-9500

jbuinfo@jbu.edu

A Premier Christian University in Northwest Arkansas

The future you starts at JBU.

A Premier Christian University in Northwest Arkansas

The future you starts at JBU.

A Premier Christian University in Northwest Arkansas

The future you starts at JBU.

A Premier Christian University in Northwest Arkansas

The future you starts at JBU.

A Premier Christian University in Northwest Arkansas

The future you starts at JBU.

A Premier Christian University in Northwest Arkansas

The future you starts at JBU.

On-campus undergraduate

In-person bachelor's degrees. Best for recent high school graduates and transfer students looking for a traditional on-campus college experience.

Graduate

In-person and online master's degrees and certificates in business, counseling, cybersecurity and education. Best for professionals and college graduates.

Online undergraduate

Fully online bachelor's degrees. Best for students looking to earn their first degree in a flexible online format.

Prepare to honor God and serve others.

For Christians, faith and learning are inseparable. You will be challenged to cultivate the fruits of the Spirit in every class.

Be equipped for a successful career.

Our academic programs are designed to guide you into professional success. Hands-on experiences and rigorous academics will equip you to impress employers or start grad school.

Grow into your calling.

Our unique approach to education is designed to cultivate your whole person – head, heart and hand. Your holistic growth will transform you into a more earnest believer, a better neighbor and a more effective professional.

Find your calling.

From STEM to business to the arts, find the right major for you.

Be in community

Hard work is important, but so is your mental and spiritual health. At JBU, you’ll be welcomed into a community of good friends and caring mentors that will help you thrive and enjoy life.

John Brown University is a Christ-centered university for students who want a top-notch education.

Founded in 1919, JBU is a leading Christian college providing a highly-ranked academic, spiritual and professional foundation for world-impacting careers.

JBU is Arkansas' top-ranked university (the Wall Street Journal) and among the top-10 regional universities in the South (U.S. News & World Report). JBU enrolls more than 2,200 students from 37 states and 48 countries in its in-person and online undergraduate and graduate programs.

About JBU

JBU, Upskill NWA Partnership to Help Underemployed Adults Become Nurses

SILOAM SPRINGS, Arkansas (Mar. 28, 2024) – John Brown University is partnering with Upskill NWA to create a referral and support system to assist and support underemployed adults who want to earn a Bachelor's degree in nursing.

The partnership will increase access and success rates of participants through a strengthened and guided recruitment, onboarding, advising and academic support process.

The program is open to both new and current JBU nursing students who meet Upskill NWA's eligibility requirements.

"Upskill NWA is proud to partner with the esteemed John Brown University to help provide our western Benton County residents with even more support as they pursue their dreams to have a high demand, high wage career in nursing," said Carol Moralez, president and CEO of Upskill NWA.

Upskill NWA will assign each participant a career navigator to provide individual case management services to assist students, as well as cover the cost of tuition, tutoring, textbooks and supplies for each participant for the duration of their enrollment.

JBU will assist Upskill NWA in connecting participants to supportive services at JBU and work to identify student scholarships and referrals for participants.

"We are thrilled to collaborate with Upskill NWA to empower aspiring nurses," said Natasha Trotter, department chair of nursing at JBU. "Together, we aim to cultivate a nurturing environment where students can thrive and fulfill their potential in the nursing field, ultimately contributing to the betterment of healthcare and our community."

To see the eligibility requirements for the program, please visit https://upskillnwa.com/apply#eligibility-requirements.

For information on JBU's nursing program, please visit www.jbu.edu/nursing.

John Brown University is a leading private Christian university, training students to honor God and serve others since 1919. Arkansas’ top-ranked university (The Wall Street Journal) and top-ranked regional university (U.S. News), JBU enrolls more than 2,200 students from 37 states and 42 countries in its traditional undergraduate, graduate, online and concurrent education programs. JBU offers over 50 undergraduate majors, with top programs including nursing, psychology, business, computer science, construction management, graphic design, family and human services, and engineering. Eighteen graduate degrees are available in business, counseling, cybersecurity, and education.

March 28, 2024

JBU Graduate Counseling Program Receives CACREP Accreditation

SILOAM SPRINGS, Arkansas (Mar. 8, 2024) – John Brown University's graduate counseling program received accreditation from the Council for Accreditation of Counseling and Related Educational Programs.

CACREP Accreditation provides recognition that the content and quality of the program has been evaluated and meets standards set by the profession.

The Board of Directors of the Council for CACREP met January 11-13, 2024, and decided to accredit the clinical mental health counseling program at JBU.

"We are very proud of achieving CACREP accreditation as it affirms the quality of our counseling program and its faculty, staff, students and graduates," said Chris Hull, department chair of graduate counseling. "This accreditation provides our graduates with a smoother and simpler pathway to achieving professional counseling licensure in most states across America."

The Board based the accreditation decision on an extensive review of the self-study documents, the site review team’s report, and the institution’s response to the site review team’s report.

The accreditation runs through March 31, 2032, and provides retroactive recognition for program graduates that extends back to January 13, 2022.

"The 10 year cycle also ensures that hundreds of JBU counseling students will earn a degree from a nationally recognized program at a faith-based institution and thus, be better able to honor God and serve others through the counseling profession," Hull said.

For more information about the JBU counseling program, please visit https://www.jbu.edu/graduate/degree-programs/ms-counseling/.

John Brown University is a leading private Christian university, training students to honor God and serve others since 1919. Arkansas’ top-ranked university (The Wall Street Journal) and top-ranked regional university (U.S. News), JBU enrolls more than 2,200 students from 37 states and 42 countries in its traditional undergraduate, graduate, online and concurrent education programs. JBU offers over 50 undergraduate majors, with top programs including nursing, psychology, business, computer science, construction management, graphic design, family and human services, and engineering. Eighteen graduate degrees are available in business, counseling, cybersecurity, and education.

March 8, 2024

JBU Adds Bachelor's Program in Artificial Intelligence

SILOAM SPRINGS, Arkansas (Feb. 19, 2024) — John Brown University announced a new undergraduate degree in artificial intelligence, beginning in the fall of 2024, making it the first Christian university in the U.S. to offer a bachelor's in the field.

According to Bloomberg Intelligence, the current generative AI market is approximately $40 billion and is expected to grow to $1.3 trillion by 2032. While AI has come to the forefront of more discussions with the public launch of programs like ChatGPT, it has been in use for decades, and most people use it every day without thinking about it. AI impacts everyday life, from real-time traffic monitoring in navigation apps to smart-home devices, search engine algorithms, banking fraud alerts and spell-check software.

“AI has enormous potential to improve health care, make education more accessible, improve economic health, increase online child safety and much more,” said Ted Song, Ph.D., JBU’s chief innovation officer. “JBU’s Christ-centered approach to education will empower our alumni to enter the field, not just with technical skills but with a strong perspective on the ethical use of AI.”

JBU added a minor in artificial intelligence in 2023, but with the growing interest in the field, the university has made it available as a Bachelor of Science or Bachelor of Arts degree. Only about a dozen universities in the U.S. offer a full bachelor’s degree in artificial intelligence, instead many colleges only offer a concentration or certification within a broader computer science based degree.

Students in JBU’s AI degree program can incorporate the AI degree with other academic interests such as business, data analytics, engineering, mathematics and natural sciences.

“The artificial intelligence major will teach students to think and solve real-world problems using logic and technology from a Christian worldview,” said Justus Selwyn, Ph.D., chair of the computer science department. “In an era of rapid technological advancement, students passionate about innovations are welcomed to join our team to become AI technocrats and valuable solution providers to the dynamic world of AI." For more information about the program, visit jbu.edu/majors/artificial-intelligence or email Justus Selwyn at jselwyn@jbu.edu .

John Brown University is a leading private Christian university, training students to honor God and serve others since 1919. Arkansas’ top-ranked university (The Wall Street Journal) and top-ranked regional university (U.S. News), JBU enrolls more than 2,200 students from 37 states and 42 countries in its traditional undergraduate, graduate, online and concurrent education programs. JBU offers over 50 undergraduate majors, with top programs including nursing, psychology, business, computer science, construction management, graphic design, family and human services, and engineering. Eighteen graduate degrees are available in business, counseling, cybersecurity, and education.

February 19, 2024

JBU Awards Six Full-Tuition Presidential Scholarships

SILOAM SPRINGS, Arkansas (Feb. 13, 2024) - John Brown University awarded the final three Presidential Scholarships this past week to Darissa Ennes from Monet, Missouri; Citlali Oritz Tinajero from Rogers, Arkansas; and Abrie Ables from Malvern, Arkansas.

Each year, JBU hosts a Scholarship Competition in November and February and invites prospective students who qualify based on academic performance. The competition includes rigorous interviews conducted by various faculty and staff on the JBU campus.

From the two weekends, JBU awarded Presidential Scholarships to six students who demonstrated great academic achievement as well as social and spiritual maturity. The scholarship is valued at $120,000, awarded over four years.

The other three Presidential Scholarship winners announced in the fall were Ryane Owens from Bixby, Oklahoma; Luis Chojolan from Guatemala; and Grace Higley from Bentonville, Arkansas.

JBU also awarded more than $4 million in Chancellor's Scholarships to some of the students that participated in the competition.

For more information on scholarships at JBU, please visit jbu.edu/scholarships.

John Brown University is a leading private Christian university, training students to honor God and serve others since 1919. Arkansas’ top-ranked university (The Wall Street Journal) and top-ranked regional university (U.S. News), JBU enrolls more than 2,200 students from 37 states and 42 countries in its traditional undergraduate, graduate, online and concurrent education programs. JBU offers over 50 undergraduate majors, with top programs including nursing, psychology, business, computer science, construction management, graphic design, family and human services, and engineering. Eighteen graduate degrees are available in business, counseling, cybersecurity, and education.

February 14, 2024

John Brown University to Accelerate Cybersecurity Program with Support from Walton Family Charitable Support Foundation

SILOAM SPRINGS, Arkansas (Jan. 9, 2024) – John Brown University will accelerate the growth of the university’s cybersecurity program and help develop local talent to meet workforce needs.

A $6.5 million grant from the Walton Family Charitable Support Foundation will establish an endowment with $3 million designated to fund student scholarships, $2 million for technology and $1.5 million for a full-time program faculty.

“There is a critical need for cybersecurity professionals in Arkansas,” said JBU President Chip Pollard. “JBU undergraduate and master-level students will benefit greatly from the dedicated faculty, the up-to-date software and hardware, and the scholarships this generous grant provides.”

In 2020, JBU became the only university in Northwest Arkansas to offer a bachelor’s degree in cybersecurity. In these early years, the program has approximately doubled its student numbers each fall.

“JBU’s holistic approach to education empowers our graduates to master not just the technical knowledge but also develop the ability to solve problems, think critically and communicate thoughtfully,” said Ted Song, Ph.D., chief innovation officer at JBU. “Industry leaders tell us that JBU graduates have the soft skills that make them great leaders as they grow in the profession.”

JBU’s bachelor of science in cybersecurity is available in the university’s traditional on-campus program and a fully online format designed for working adults.

The school also offers MBA and M.S. programs in cybersecurity, which students can start during their undergraduate studies and complete in just one additional year through JBU’s accelerated master’s program.

Song says that the 4 + 1 track has been vital in recruiting high school students interested in this growing industry.

The $6.5 million grant is the second-largest gift to JBU’s Steadfast Faith capital campaign. The campaign seeks to strengthen JBU’s mission for the future by raising $100 million for academic programs, construction projects, scholarships and operations. To date, JBU has received $67 million from donors. Read more about the campaign at jbu.edu/steadfast-faith.

John Brown University is a leading private Christian university, training students to honor God and serve others since 1919. Arkansas’ top-ranked university (The Wall Street Journal) and top-ranked regional university (U.S. News), JBU enrolls more than 2,200 students from 37 states and 42 countries in its traditional undergraduate, graduate, online and concurrent education programs. JBU offers over 50 undergraduate majors, with top programs including nursing, psychology, business, computer science, construction management, graphic design, family and human services, and engineering. Eighteen graduate degrees are available in business, counseling, cybersecurity, and education.

January 8, 2024

Ted Song Named a 2023-2024 CCCU Presidential Fellow

SILOAM SPRINGS, Arkansas (Nov. 10, 2023) – The Council for Christian Colleges & Universities announced that Ted Song, Ph.D., chief diversity officer at JBU, has been selected as one of the first three CCCU Presidential Fellows along with Keith Hall, Ph.D., (Azusa Pacific University) and Sarah Visser, Ph.D., (Calvin University).

The Presidential Fellowship Program is a new, yearlong fellowship to prepare leaders to answer the call to the Christian college presidency. Each year, the CCCU will select one to three individuals for the fellowship who currently serve or have previously served as CCCU commissioners and who demonstrate exceptional strength of character, competence and leadership potential.

During the one-year fellowship program, Presidential Fellows will access numerous opportunities for professional development, leadership development and networking.

Song is associate professor of electrical engineering, chief diversity officer and chief innovation officer at John Brown University. He also serves as vice president of the Christian Engineering Society and chair of the CCCU’s Diversity and Inclusion Commission.

“On behalf of the JBU community, I want to congratulate Dr. Ted Song for being named an inaugural CCCU Presidential Fellow,” said JBU President Chip Pollard. “We know of Ted’s excellence and faithfulness, not only to the mission here at JBU but also to other institutions in the CCCU, and we are grateful for this opportunity for him to grow in his leadership.”

For more information about the CCCU’s Presidential Fellows Program, contact Chief Advancement Officer Jill Hartness at jhartness@cccu.org.

John Brown University is a leading private Christian university, training students to honor God and serve others since 1919. Arkansas’ top-ranked university (The Wall Street Journal) and top-ranked regional university (U.S. News), JBU enrolls more than 2,200 students from 37 states and 42 countries in its traditional undergraduate, graduate, online and concurrent education programs. JBU offers over 50 undergraduate majors, with top programs including nursing, psychology, business, computer science, construction management, graphic design, family and human services, and engineering. Eighteen graduate degrees are available in business, counseling, cybersecurity, and education.

November 9, 2023

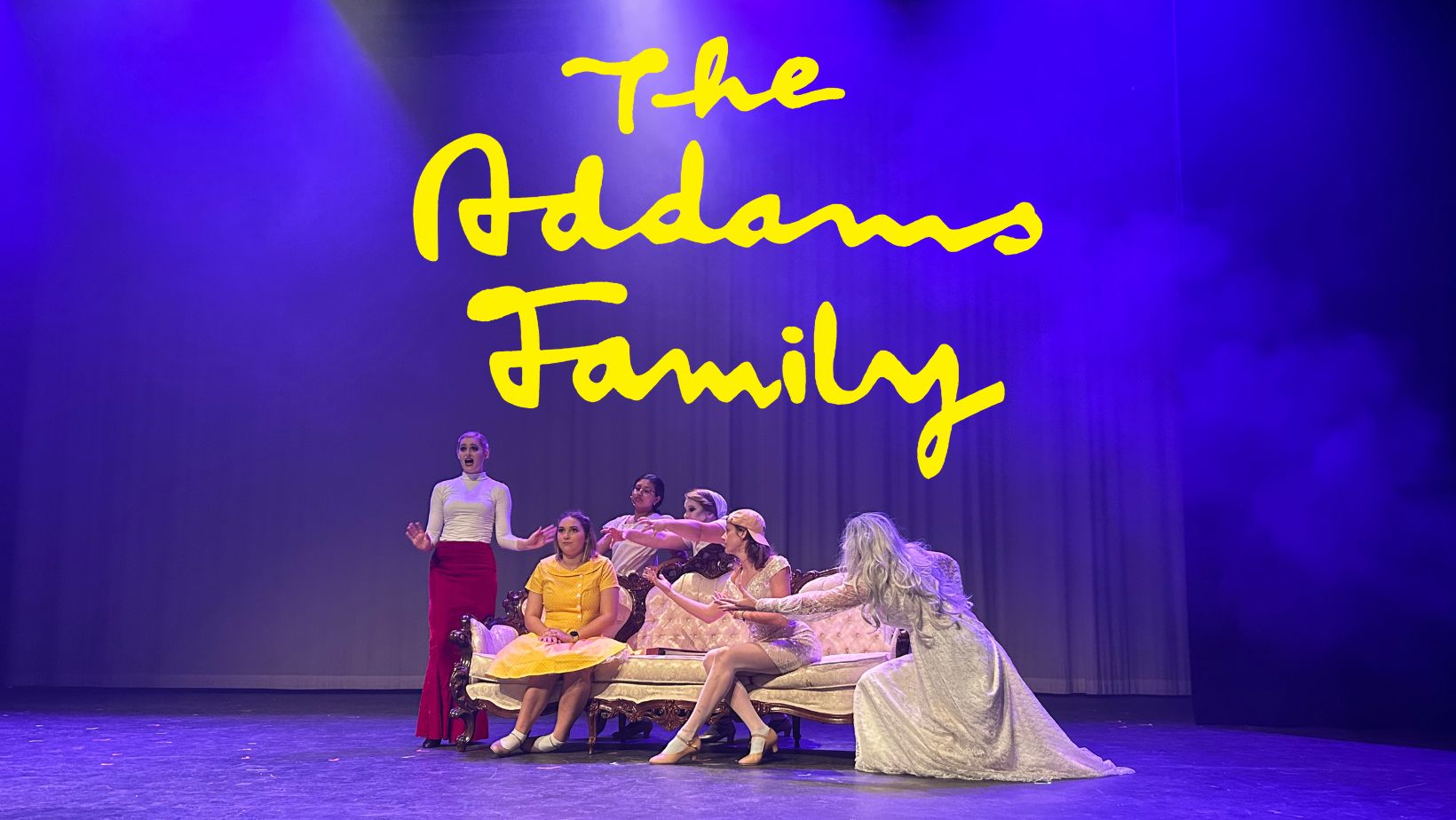

JBU Music & Theatre to Present 'The Addams Family'

SILOAM SPRINGS, Arkansas (Oct. 27, 2023) - John Brown University Music & Theatre will present "The Addams Family," music and lyrics by Andrew Lippa, book by Marshall Brickman and Rick Elice, Oct. 27-28 at 7:30 p.m., and Nov. 2-4 at 7:30 p.m., at the Berry Performing Arts Center on the Siloam Springs Campus.

Based on the classic characters created by Charles Addams, "The Addams Family" is a wacky musical comedy that celebrates family and love in the most unlikely of places.

"The Addams Family is a goofy, wacky, weird musical comedy that is somehow so relatable and touching," said Liesl Dromi, assistant professor of music at JBU. "Our team of music & theatre students, faculty, staff, and local professional musicians have had an absolute blast bringing this production to life. We hope our audiences enjoy it as much as we do!"

You can purchase tickets by phone at (479) 524-7382, at jbu.edu/tickets, or at the door the night of the performance. Tickets are $16 for adults, $14 for senior adults, JBU alumni, faculty and staff, $7 for students and $3 for JBU students.

John Brown University is a leading private Christian university, training students to honor God and serve others since 1919. Arkansas’ top-ranked university (The Wall Street Journal) and top-ranked regional university (U.S. News), JBU enrolls more than 2,200 students from 37 states and 42 countries in its traditional undergraduate, graduate, online and concurrent education programs. JBU offers over 50 undergraduate majors, with top programs including nursing, psychology, business, computer science, construction management, graphic design, family and human services, and engineering. Eighteen graduate degrees are available in business, counseling, cybersecurity, and education.

October 26, 2023

JBU Toilet Paper Game Packs Arena for 40th Anniversary

SILOAM SPRINGS, Arkansas (Oct. 27, 2023) - The tradition started on Nov. 12, 1983, when a group of J. Alvin Brown Hall residents and members of the rugby team decided to encourage students to sneak in rolls of toilet paper and let them fly when the Golden Eagles men's basketball team scored the first field goal of the season-opening game.

Jeff Berggren ’84 was serving as the sports information director during the game and admitted that students weren't sure what head coach Curt Pickering would think about their technical-foul inducing stunt. Luckily, the team won the game and a tradition was born.

"Of course, we paid the price the next day with no toilet paper in J. Alvin until the janitors replenished the supply," Berggren said.

It still took several years before the tradition was embraced wholeheartedly by the school and became the students' most-loved tradition.

Students no longer have to raid the school TP supply thanks to a partnership with Kimberly-Clark who has donated 4,000 rolls of toilet paper for the game for the last seven years. Fans exchanged canned food items for a roll of TP to toss, and the other 2,000 rolls will be donated, along with the canned food items, to the Manna Center, a local food bank in Siloam Springs.

This year's game against Barclay (Kan.) was no exception with a packed-out crowd at Bill George Arena.

When junior guard Drew Miller sunk the first basket from 3-point range 47 seconds into the game, the crowd let loose and sent a cascade of toilet paper streaming onto the court from all sides.

"It's such a special small college tradition, and every player gets excited about the first game," said Jason Bescheta, head coach of the men's basketball team. "It builds an incredible energy throughout the entire JBU community."

JBU's TP game is hailed as "the best technical foul in all of sports" by USA Today, was featured on CBS's March Madness Fandemonium special in 2016, and received coverage by ESPN multiple times.

October 26, 2023

Sign up for personalized information and deadline reminders

Loading...

Join JBU's Contact List

Sign up for personalized information and deadline reminders

Loading...